Property Analysis - March, 2018 Week 3

- Matthew Mckinivan

- Mar 20, 2018

- 1 min read

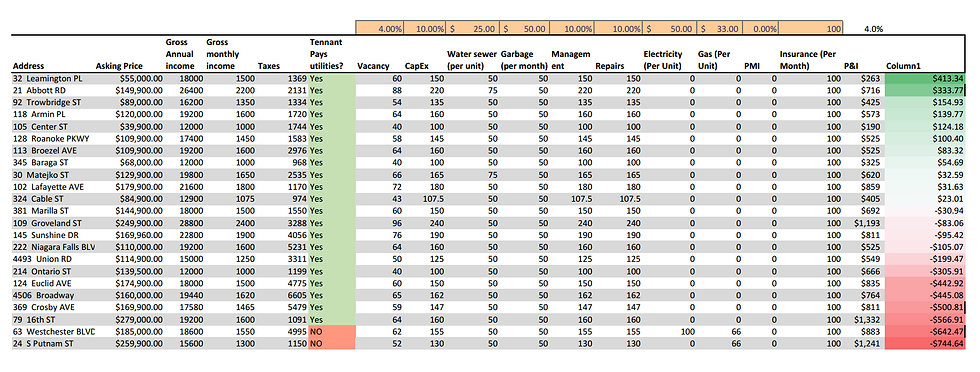

Greetings everyone, Hope you're having an excellent week. We are looking at Buffalo, Ny multi-units and which ones even on the MLS may cash flow. As always, these are meant to be a BASIC look into the current properties on the market and how they may produce positive or negative cash flows. We always urge you to take a much closer look into these deals to see how many factors may affect actual cash flow.

An easy deal this week may be 92 Towbridge St in South Buffalo. Listed at $90k, with both units rented out (below market IMO) at $675/ea you are still receiving close to $100 per door. A small increase in rent would have you easily above that threshold.

One thing I've noticed in the pictures would be a possible need for siding in the near future. Depending on the condition, we would have to take into account an increase in CAPEX early in the life of the rental.

Our Philosophy is to focus on long term profitability and sustainability, as we think this is a much more stable way of doing business and ends up with happier owners as well as renters. By bringing mechanical and structural systems up to date as quickly as possible, we can better plan on CAPEX numbers to replace systems as they near their end of life.

Comments